Medicare supplement insurance plans in Houston, Texas 77067, Harris County are designed to cover what Medicare doesn’t pay in full. Contact us at (888) 373-4315 for a free, instant price comparison!

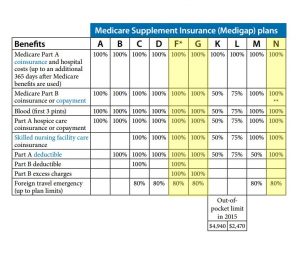

You feel a little overwhelmed when it comes to picking plans which are going to fit your own personal needs if you are on Medicare or if you are planning to become eligible for Medicare in the near future. You will find still planning to be out of pocket expenses which you may not want to have to pay for as it pertains to the original Medicare which includes Parts A and B. That is where the supplemental plans come into play. The ones we are going to be going over here are plans F, G, and N.

Each one of the supplement plans is offered by private insurance companies all over the country as well as the prices of those plans will vary from one insurer to another. However, the benefits which you reap from each plan will undoubtedly be standardized according to each letter of the plans which are offered. What this ensures that say for instance you choose Plan F, the coverage that the plan offers will be the same no matter what insurance company you opt to deal with.

Texas Medicare Supplement Plan F

Plan F tends to be a popular pick for most people because it offers a lot more coverage than other supplement plans. It’s important to notice there are two types that are different. There is the standard Plan F and another one that has the same benefits as the standard but comes with a higher deductible. This means if you were to choose the higher deductible ahead of the coverage would begin, that you simply would need to first pay a certain amount of money. Call (888) 373-4315 for a free quote on Plan F today!

Benefits which can be included with all the Plan F include most of the following:

- Part A Medicare coinsurance along with hospital costs along with an additional year of coverage after your Medicare benefits have been used up.

- Covers the coinsurance or copayment of hospice care that Part A doesn’t cover.

- It covers the Part A deductible.

- Pays for the deductible for Part B.

- If there are any Medicare Part B extra charges this plan will cover these charges.

- If you require blood, this plan will cover the first three pints of blood needed.

- If you are in a skilled nursing facility it will cover the coinsurance amounts that might be required.

- Will cover any emergency coverage that might be needed during foreign traveling.

If you decide that you just want to pick the higher deductible plan then you’ll be required to pay for each of the out of pocket costs until you’ve reached a certain amount the original Medicare doesn’t cover. In 2017, that amount was before this plan kicked in. But, by choosing the higher deductible plan you could end up paying a much lower monthly amount than with the standard Medigap Plan F.

Normally it’ll be the most expensive plan, however, in case you shop around, since Plan F does offer the largest amount of benefits you can locate a plan that’s less expensive.

TX Medicare Supplement Plan G

This particular Medigap plan is one that offers most of the same benefits as that of Plan F. There’s one exception, however, it does not cover the deductible for Medicare Plan B. What this means is that if you go with Plan G you will still need to pay the yearly standard Part B deductible. That deductible in 2017 was $183. Therefore, should you not mind paying for this deductible amount, Plan G could be a good option to consider when it comes with benefits that are good. For a free quote on Plan G call us directly at (888) 373-4315 today!

You need to know they’re the only two Medigap plans that do this and that both of these plans do cover all excess charges that may accrue with Part B Medicare. These excess costs would be the actual difference between what a doctor charges due to their medical service and what the approved Medicare amount is. These professionals are considered to be non-participating providers and they’re allowed to actually charge just as much as 15% more than what Medicare allows for a certain covered medical service. This extra amount is what the patient would be expected to pay from their own pocket.

Medicare Supplement Plan N

This is really a supplemental plan that offers a whole lot of the same benefits but there really are a few exceptions which you need to be aware of when looking at this particular plan which is listed below:

- Plan N does not cover the deductible that comes with Part B Medicare.

- It doesn’t cover the extra charges that might come with Part B.

So, what this implies is that you’ll be responsible for paying for all these differences. It’s another difference, despite the fact that it will pay 100% of the coinsurance of Medicare Part B most of the time in regards to Plan N, there may be exceptions. Those differences are you can really be required to pay a copay of up to $50 for some ER visits that don’t end up with admission and that you need to pay just as much as $20 for some office calls. Give us a call at (888) 373-4315 for a free quote on Plan N today!

What Insurance Insurers Are Best?

There are a lot of insurance companies to choose from. Some of the best companies are UHC, AARP, BCBS, Aetna, Mutual Of Omaha, Cigna, American Continental, Loyal American, Medico, Equitable, USAA, UnitedHealthcare, Humana, Continental Life, Bankers Life, Colonial Penn, Manhattan Life, New Era Life, Transamerica, Physicians Mutual, Combined Insurance, American Republic, CSI, American Retirement, Oxford Life, GPM Life.

What Is The Best Time to Enroll In A Plan?

If you’re considering signing up for any of these Medigap plans you need to know that the best time to enroll in almost any of them would be during what is referred to as the a Medicare Supplement Open Enrollment Period. This starts when you’re 65 years old or older and you already have Part B Medicare. This is a six month time period that provides you a special right to join any kind of Medigap plan which is offered by any insurer in your area.

Give us a call at (888) 373-4315 for the best rates on Medicare supplement plans in Houston, TX 77067!

Related Posts: