Medigap Plans in El Paso, Texas 88540, El Paso County are designed to cover what Medicare does not pay in full. Contact us at (888) 373-4315 for a free, instant price comparison!

If you are on Medicare or if you’re planning to become eligible for Medicare you more than likely feel a little overwhelmed in regards to picking plans which will fit your own personal needs. As it pertains to the original Medicare which includes Parts A and B, there are still planning to be out of pocket expenses which you might not want to have to pay for. This is where the supplemental plans come into play. The ones we are going to be going over here are G plans F, and N.

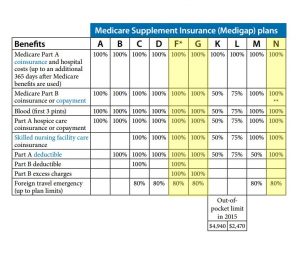

Each one of the supplement plans is offered by private insurance companies all over the country and the prices of the plans will vary from one insurer to another. The benefits that you reap from every plan will soon be standardized according to each letter of the plans that are offered. What this implies that say for instance you choose the coverage the plan offers will be exactly the same, Plan F no matter what insurance company you opt to deal with.

Texas Medicare Supplement Plan F

Plan F tends to be a very popular pick for a lot of people because it actually offers a lot more coverage than other supplement plans. It is important to note that there are two different types. There is certainly the standard Plan F and another one that has the same benefits as the standard but comes with a higher deductible. This implies if you were to choose the deductible that is higher that you simply would need to first pay a certain amount of money prior to the coverage would even begin. Call (888) 373-4315 for a free quote on Plan F today!

Benefits which might be included with the Plan F include every one of the following:

- Part A Medicare coinsurance along with hospital costs along with an additional year of coverage after your Medicare benefits have been used up.

- Covers the coinsurance or copayment of hospice care that Part A doesn’t cover.

- It covers the Part A deductible.

- Pays for the deductible for Part B.

- If there are any Medicare Part B extra charges this plan will cover these charges.

- If you require blood, this plan will cover the first three pints of blood needed.

- If you are in a skilled nursing facility it will cover the coinsurance amounts that might be required.

- Will cover any emergency coverage that might be needed during foreign traveling.

Should you decide that you just want to pick the higher deductible plan you’ll be required to pay for all the out of pocket costs until you’ve reached a certain amount, the original Medicare does not cover.

Since Plan F does offer the largest amount of benefits it’s going to be the most expensive plan, however, if you shop around you could find a plan that is less expensive.

TX Medicare Supplement Insurance Plan G

This particular Medigap plan is one that offers many of the same benefits. There is one exception, however, it does not cover the deductible for Medicare Plan B. This means that if you go with Plan G you are going to need to pay the yearly standard Part B deductible. That deductible in 2017 was $183. So, should you not mind paying for this deductible amount, Plan G could be a good option to consider when it comes with good benefits to supplemental plans. For a free quote on Plan G call us directly at (888) 373-4315 today!

You should know that both of these plans do cover all excess charges that will accrue with Part B Medicare and they’re the only two Medigap plans that do this. These excess costs are the actual difference between what a doctor charges because of their medical service and exactly what the approved Medicare amount is. These professionals are considered to be non-participating providers and they’re allowed to actually charge just as much as 15% more than what Medicare allows for a certain covered medical service. This extra amount is exactly what the patient would be expected to pay out of their own pocket.

Medicare Supplement Insurance Plan N

This really is a supplemental plan that offers a whole lot of the same benefits but there are a few exceptions which you should be aware of when looking at this particular plan which will be listed below:

- Plan N does not cover the deductible that comes with Part B Medicare.

- It doesn’t cover the extra charges that might come with Part B.

So, what this means is that you would be responsible for paying for these differences. It has another difference, despite the fact that it will pay 100% of the coinsurance of Medicare Part B most of the time when it comes to Plan N, there may be exceptions. Those differences are that you need to pay as much as $20 for some office calls and you also can be required to pay a copay of up to $50 for some ER visits that don’t end up with admission. Give us a call at (888) 373-4315 for a free quote on Plan N today!

What Insurance Insurers Are Best?

There are a lot of insurance companies to choose from. Some of the best companies are UHC, AARP, BCBS, Aetna, Mutual Of Omaha, Cigna, American Continental, Loyal American, Medico, Equitable, USAA, UnitedHealthcare, Humana, Continental Life, Bankers Life, Colonial Penn, Manhattan Life, New Era Life, Transamerica, Physicians Mutual, Combined Insurance, American Republic, CSI, American Retirement, Oxford Life, GPM Life.

What Is The Best Time to Enroll In A Plan?

If you might be considering signing up for any of these Medigap plans you need to know that the best time to enroll in almost any of them would be during what is called the a Medicare Supplement Open Enrollment Period. This starts when you’re older or 65 years old and you have Part B Medicare. This time period offers you a guaranteed issue.

Give us a call at (888) 373-4315 for the best rates on Medicare supplement plans in El Paso, TX 88540!

Related Posts: